Rolling Refunds: Inside the EITC Bus Tour with LAVITA & Golden State Opportunity

August 20, 2025This spring and summer, Golden State Opportunity and LAVITA took financial empowerment on the road–literally.

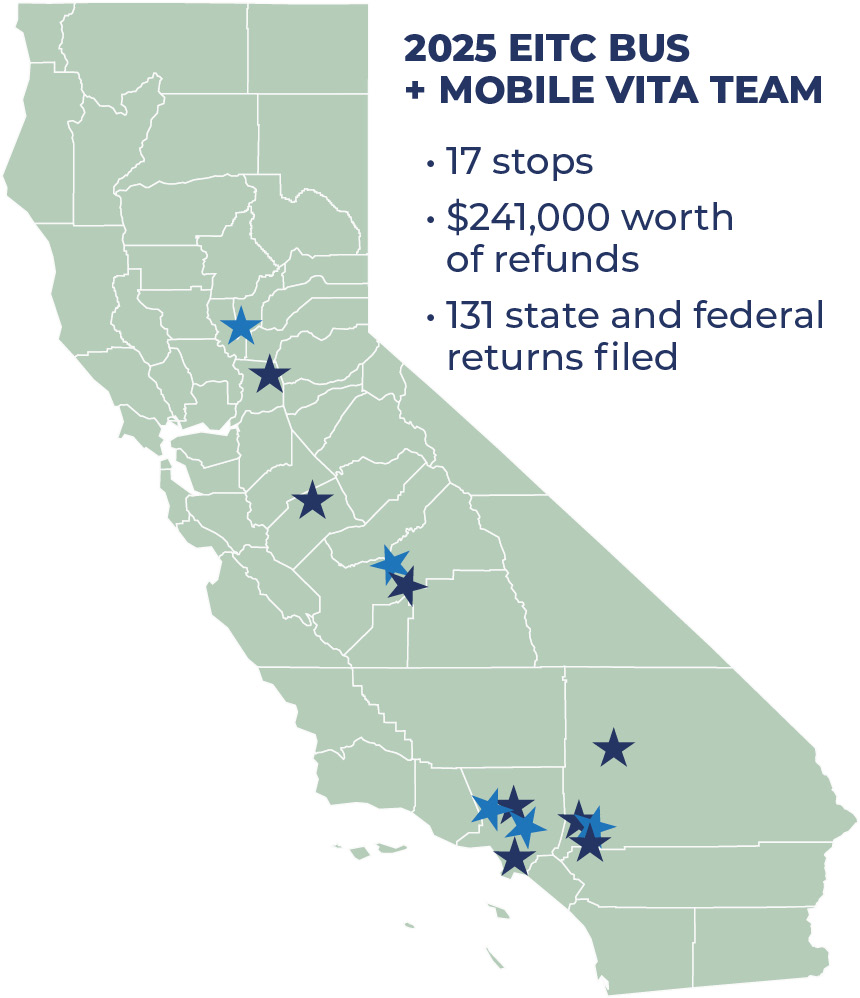

As part of a groundbreaking 17-stop tour across California, GSO’s network partnered to deliver free tax preparation, financial education, and critical resources to the communities that need them most. The centerpiece? The EITC bus, a mobile tax clinic outfitted with 13 workstations and staffed by trained VITA (Volunteer Income Tax Assistance) volunteers, designed to make tax help as accessible as a neighborhood stop.

From the gurdwaras of the Central Valley to wildfire-impacted neighborhoods in Altadena, the EITC bus built trust and connected with individuals and organizations long unserved. The bus didn’t just help people file their taxes—it helped them take the first big step toward greater financial stability for their families. It also tackled a growing challenge that has become especially urgent: VITA deserts—areas of California where access to free tax preparation services for low-income individuals and families is nonexistent.

From the gurdwaras of the Central Valley to wildfire-impacted neighborhoods in Altadena, the EITC bus built trust and connected with individuals and organizations long unserved. The bus didn’t just help people file their taxes—it helped them take the first big step toward greater financial stability for their families. It also tackled a growing challenge that has become especially urgent: VITA deserts—areas of California where access to free tax preparation services for low-income individuals and families is nonexistent.

This leaves residents with few good solutions. They must either travel great distances to access free tax prep or pay for tax preparation services in their community, costing $250 on average. As a result, many people choose not to file their taxes at all and hundreds of thousands of dollars in tax credits go unclaimed each year.

“At every stop, people were asking how they could bring a VITA site to their own community,” said Aragas Mandani, LAVITA Executive Director. “We met community-based organizations everywhere interested in expanding VITA availability—especially in places like Riverside and San Bernardino. Counties where these services are almost nonexistent outside of urban areas. This tour wasn’t just about preparing returns—it was about planting the seeds for a network of support that can continue long after the bus moves on.”

These conversations are already turning into action. LAVITA and GSO are now working with several of the organizations they met on the road to help them become certified VITA sites, paving the way for a more permanent presence of free tax prep.

For Andy Rodriguez, Golden State Opportunity’s Organizing Manager, the bus tour wasn’t just an expansion of services—it was going even deeper in GSO’s work of building community and trust.

“The EITC Bus Tour really showed us the power of presence,” Rodriguez said. “Instead of waiting for people to come to us, we showed up in their communities—in their neighborhoods, their places of worship, their libraries. We talked face-to-face, listened to their needs, and built trust. That kind of accessibility changes everything.”

And people responded. Over the course of the tour, the mobile VITA team filed hundreds of returns and unlocked thousands of dollars in tax credits for Californians. In total, the tour saw $241,000 worth of refunds and 131 state and federal returns filed.

One of them was Claudia, a single mother who needed to file her taxes for 2022, 2023, and 2024. She hadn’t been able to afford a paid preparer and didn’t know where to turn. Thanks to the EITC bus and its crew, she got all three years filed at no cost. Claudia qualified for both the Earned Income Tax Credits (EITCs) and Additional Child Tax Credit (ACTC), receiving a combined refund for the three years filed of $16,674 in federal credits and $1,048 in state credits.

She plans to use part of the refund to open a bank account for her son’s future college education.

“I didn’t even know help like this existed,” she said. “I’m so grateful they came to my community. This is going to change things for my family.”

As taxes grow more complex, and the cost of filing continues to rise, initiatives like the EITC Bus Tour are proving that real solutions must be flexible, multilingual, and community-driven.

“Golden State Opportunity, working hand-in-hand with our partner organizations, took the EITC Bus on the road to reach communities that had long been overlooked—offering free tax preparation, unlocking refunds, and sparking new opportunities,” said Citlalli Lizarraga, CalEITC+ Project Manager. “Our unique method of outreach–the EITC bus–also allowed us to bring language access and education directly to more than just the communities we were in. We heard that so many of the tax filers we served were coming from even more rural outlying communities.”

Golden State Opportunity and LAVITA are already planning for next year and, with dozens of new partnerships formed, hundreds of returns filed, and lives changed along the way, one thing is clear: this effort is just getting started.

Thank you to all of our partners on this project including: California Treasurer Fiona Ma, Senator Eloise Gomez Reyes, Senator Sasha Perez, Assemblymember Stephanie Nguyen, Jakara Movement, LAVITA Community Financial Organization, San Juan Bautista City Library, Project SCOUT, Asian Resources Incorporated, El Centro de Amistad, Pacoima Charter School, Antelope Valley Partners for Health, Altadena Library, the City of Hesperia, San Bernardino County Library, and Chaffey College Fontana Campus.

And a special thank you to The Community College Foundation and their COO, Ingrid Jimenez for mentoring us on successful mobile outreach and access to the EITC Bus. Also, thank you to Igor Kostyshak, the driver of the EITC Bus and expert parallel parker!