I’m proud to share Golden State Opportunity’s 2025 Mid-Year Report with you.

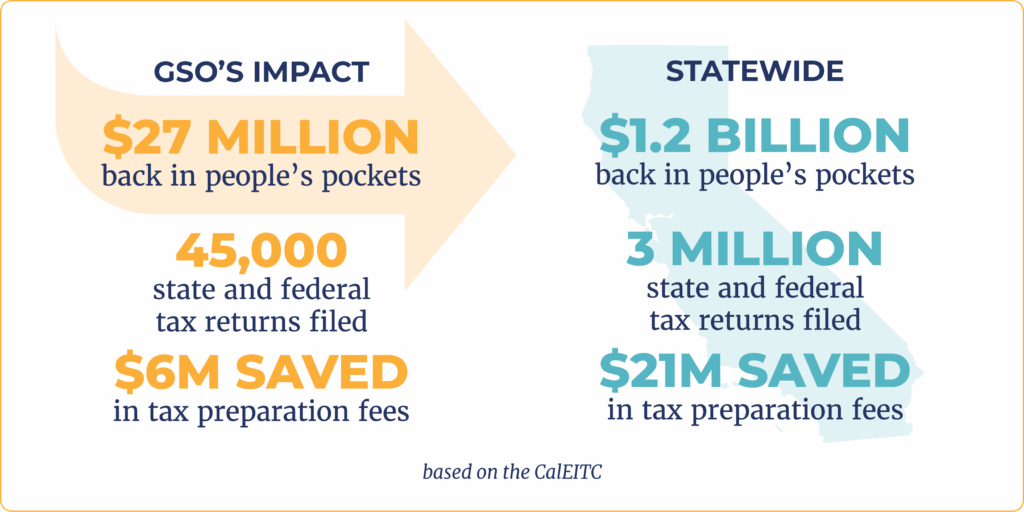

For the fifth year in a row, more than $1 billion has been claimed through the CalEITC program by working Californians. Of that $1 billion, Golden State Opportunity’s CalEITC campaign directly put $30 million into people’s pockets. That is $30 million of food on tables, rent payments made, cars fixed and daycare secured.

For all the strides we have made – detailed throughout this report – tax season also coincided with the Trump Administration’s move to dismantle the federal government as we know it. We know that the current policies and systems are, and have been, insufficient in meeting the needs of workers struggling with the cost of living, yet the ferocity, cruelty, and speed this administration has employed to gut Medicaid, food stamps, and terrorize the immigrant communities has left us reeling.

While the politics around us shift, we recognize the importance of this moment and want to share what Golden State Opportunity is doing to create financial security for those who are struggling. We are laser focused to ensure every eligible worker claims the dollars they’ve already earned. As the cost of living rises and harmful policy choices threaten the financial security of low-income Californians, we’re showing up — community by community, credit by credit — with the tools, trust, and tenacity this moment demands.

In solidarity,

Amy Everitt, President

Golden State Opportunity