It’s not too late to claim tax credits

May 12, 2022Thousands of families are leaving money on the table in Santa Barbara County. That’s cash that could pay for much-needed diapers, food, rent and more. The latest numbers show that only 31,093 Santa Barbara County residents have claimed $6.1 million from the cash back tax credits like the California Earned Income Tax Credit in 2022. That’s less than last year and the year before. Don’t let your family miss out on these tax credits.

Every year, thousands of Santa Barbara County residents miss out on cash back from tax credits because they don’t file their taxes. Some people think that, since Tax Day has come and gone, they have missed out. We have good news: you haven’t! You can still claim cash back tax credits. All you have to do is file your taxes.

Both the state of California and the federal government offer thousands of dollars to maximize tax refunds and help working families thrive. There’s no penalty for filing late, and you can claim tax credits for the last three years.

With more money in your pocket, you can offset rising costs and pay for whatever you need. The tax credits you qualify for depend on how much money you earned last year and the size of your family.

In California, the Earned Income Tax Credit (CalEITC) helps working families earning less than $30,000 a year get more cash back. Parents who qualify for the CalEITC may also qualify for the Young Child Tax Credit (YCTC), which provides a state tax credit of up to $1,000 for children under 6 years old. These credits are both available to immigrants who pay taxes with an Individual Tax Identification Number (ITIN), including undocumented immigrants.

The IRS also has tax credits for people with Social Security numbers including the Earned Income Tax Credit (EITC) and the Child Tax Credit. The EITC is for workers who earned up to $57,414 last year while the Child Tax Credit provides between $3,000 and $3,600 per child, even if you don’t have recent earnings.

Remember: the easiest way to claim your money is to file your taxes, even if you don’t normally file.

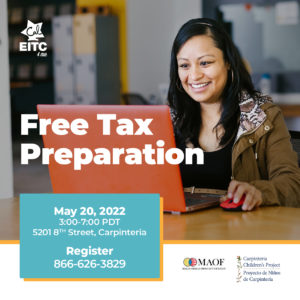

If you’re confused about how to file your taxes or worried about paying for a tax preparer, we’re here to help. Golden State Opportunity, Carpinteria Children’s Project and the Mexican American Opportunity Foundation (MAOF) are partnering to provide free, IRS-certified tax preparation in Carpinteria on May 20. Call (866) 626-3829 to sign up.

Amy Everitt is president of Golden State Opportunity, GSO is a statewide nonprofit that mobilizes people to change the systems that perpetuate poverty by creating a community-based movement while connecting low-income people with resources to build financial well-being.

Teresa Alvarez is executive director of Carpinteria Children’s Project. CCP is a nonprofit dedicated to preparing Carpinteria Valley children to enter kindergarten ready for success, regardless of the challenges they face, and promotes access to a strong network of resources Carpinteria families need to thrive.